Peter Gagarinov

CTO | PhD | Head of Development, Leadership in AI

Biography

With over two decades of immersive experience in the IT sphere, particularly in AI/ML, DevOps, and FinTech, I am thrilled at the prospect of channeling my accumulated expertise and passion into innovative endeavors.

As CTO at Potential Energy LLC, I lead the creation and launch of a cutting-edge, cloud-based SaaS platform, richly embedded with AI and ML capabilities. This venture didn’t just reinforce my technical prowess in AI/ML; it significantly bolstered my leadership skills, enabling me to guide my teams toward the fruition of ambitious, technologically advanced objectives.

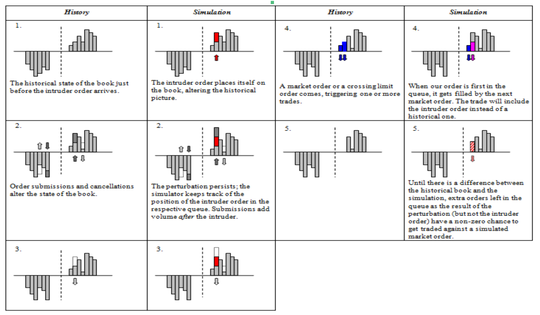

In my role as Head of DevOps and Backend Development at All of Us Financial, I was instrumental in integrating the latest technologies into our backend systems, significantly enhancing our financial platforms’ efficiency and reliability. My strategic focus on these technological advancements played a pivotal role in positioning the company as a valuable acquisition by PayPal.

My subsequent role at PayPal as Head of DevOps/Cloud Architect allowed me to leverage my previous experiences, integrating modern technologies into much larger systems. This position not only broadened my technical knowledge base but also enriched my understanding of applying cloud and ML technologies to FinTech industry, fostering innovation and adding value on a worldwide scale.

In my professional journey, which includes numerous successful projects at Allied Testing LLC, I has had a comprehensive exposure to AI/ML technologies. From hands-on development to strategic oversight, these experiences have sharpened my ability to lead teams towards the conceptualization and subsequent execution of impactful AI/ML solutions.

- Technical Leadership

- Software Engineering

- Artificial Intelligence

- DevOps

-

Advanced Deep Learning, 2020 - 2021

Deep Learning School, Phystech School of Applied Mathematics and Informatics

-

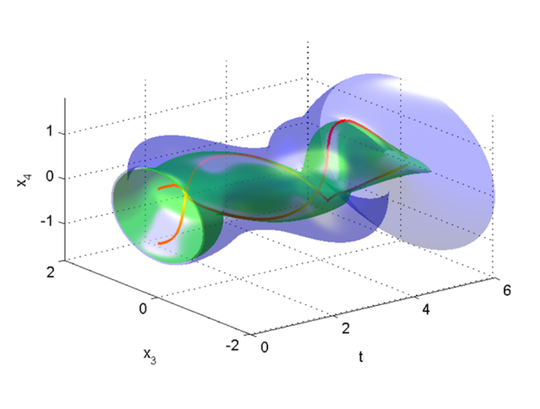

PhD in Mathematics and Computer Science, 2014

Lomonosov Moscow State University, the faculty of Computational Mathematics and Cybernetics

-

MSc in Mathematics and Computer Science, 1998 - 2003

Lomonosov Moscow State University, the faculty of Computational Mathematics and Cybernetics

Languages

Proficient/Advanced

Intermediate

Native